Do you remember watching the Star Trek television series? If you watched as many episodes as me, then you can vividly recall the crew’s use of a “yellow alert”, which raised the state of alertness upon detection of a threat. America is stabilizing from one of the worst downturns in the economy since the famed “Great Depression”, but there appears to be a looming threat on the horizon that could derail a recovery – municipal debt. Over the past three years, economists declared that commercial real estate would be the “other shoe to drop” and cause a “double-dip” recession, but more and more the condition of state and local governments is growing to become the focus of concern.

Undoubtedly, the American economy is stabilizing from the housing meltdown, credit crisis, and subsequent drop in economic production that led us to double-digit unemployment. Positive indicators in the marketplace include a recovering equities and bond market, retail sales are rising, freight traffic is increasing, consumer confidence is improving, job losses are moderating, and weekly hours worked are higher. Business owners on Main Street and the millions that remain unemployed (9.7%) or under-employed (16%) would largely disagree with my assessment. The economic recovery has not been even, so there are many areas of the country that remain under intense pressure.

The recent deterioration of the American economy is having a major impact on state budgets as revenue from personal, corporate, property, and sales taxes dwindle. During the final quarter of 2009, 41 states recorded a substantial drop in revenue. States collected $686 Billion in tax revenue during 2009, down 11.4% from the previous year. Most states addressed and some are still addressing close to $200 Billion in combined budget deficits. Conditions are not expected to get much better in fiscal year 2011 when 38 states will have combined budget deficits of $89 Billion. Fast forward to fiscal year 2012 and 31 states are projected to have combined budget deficits of $73.5 Billion. In my own state of North Carolina, the General Assembly had to embrace the changing economy when they grappled with a $4.5 Billion budget shortfall, and they may have to make further cuts if that deficit expands to a projected $6 Billion. Total outstanding debt for all municipalities is around $2.8 Trillion or 15%-20% of GDP … Is it time to signal a “yellow alert”?

Fortunately, the nation has not seen a state fail to meet their obligations since 1933, which is the year that Arkansas defaulted on its debt. Most states passed a balanced budget amendment during the “Great Depression” with the only exception being Vermont. However, local government defaults have been more frequent, because cities and counties are highly dependent on transfers from the state and feds. In addition, local government revenue is more closely tied to sensitive property and sales taxes, which often decline during a slow economy. Harrisburg, the capital of Pennsylvania, is reporting the real possibility of a bankruptcy filing. Closer to home, my local school system is wrestling with a $9 Million shortfall, and local cities are dealing with deficits that are around $10 Million.

The predicament of state and local governments matters significantly to the broader economy. The country’s 89,000 cities, school districts, and other municipalities employ 20-million people or 15% of the workforce, not to mention they are big spenders – $2.2 Trillion annually. This year alone, 84,000 jobs have been lost in state and local governments, which place further downward pressure on the economy. Higher taxes and new fees on services implemented by 29 states have generated $24 Billion in revenue during fiscal year 2010; this includes $11 Billion in personal income taxes. More taxes and fees only further stifle the economic recovery and increase the pressure on the private sector.

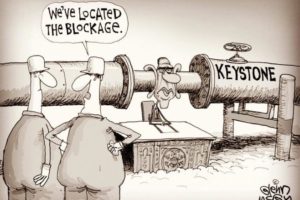

Obama is calling on Congress for another round of stimulus that will provide aid to state and local governments, but he has not identified where the funds would come from. Republicans are vigilantly resisting. The support provided by Obama’s initial stimulus bill is scheduled to expire this year, so municipalities are rightfully worried. However, I firmly disagree with any additional state or local government aid. Americans have to make tough choices with their money and how they utilize those resources. Why should government remain exempt from this exercise?

The most recent economic expansion was a boon to municipalities as property values escalated to unprecedented highs and revenue from sales taxes were strong as a result of consumer spending. Most taxpayers would like to know what happened to all the money that government received during the good years. Did they save any for the lean years? Lawmakers are entrusted with control of the public purse, so we need our leaders to make uncomfortable choices and utilize fiscal discipline. Members of both parties must recognize the critical need to further cut spending, reduce services, and reform costly entitlement programs. Otherwise, the economic recovery could be derailed by a crisis in our municipal bond market … America; we are officially on “yellow alert”.