Financial companies have longed practiced the tradition of compensating their employees with a base salary along with a “bonus” based on specific performance requirements. This allows financial firms to minimize operating expenses by keeping fixed costs low while motivating the best and the brightest to superior performance. Companies that offer a generous bonus structure will attract employees that have a drive to perform and achieve. Perhaps, taxpayers should consider imposing a similar compensation structure within the federal government.

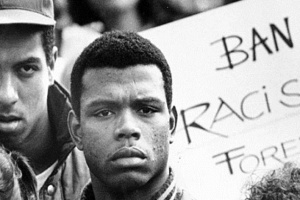

The American people became outraged when they recently learned of AIG’s intent to compensate executives with bonus payouts in spite of their overgrowing need for government assistance. Lawmakers from both parties responded to the popular outrage by picking up pitchforks and nooses for an old-fashion lynching of financial service employees. Of course, there were no “pitchforks and nooses”, but there were many “yeas” as the House of Representatives voted 328-93 to impose a 90% surtax on bonuses granted to employees who earn more than $250,000 at companies that have received at least $5 Billion from the government’s financial rescue programs. The list include popular names such as AIG, Citigroup, JP Morgan Chase, Wells Fargo, Bank of America, Goldman Sachs, Morgan Stanley, and even the newly government owned Fannie Mae and Freddie Mac.

The House bill calls for the hanging of financial service employees while the Senate version will push for a firing squad. The Senate bill would impose on both the employer and employee a 35% tax on any excessive bonus. Not to mention, the Senate version will impose the higher tax rate on any bank receiving $100 Million in federal money and it is classified as an excise tax, so it is in addition to the income tax. One bright spot is the Senate bill applies only to cash bonuses while the House version will apply to such payments as restricted stock.

The punitive legislation approved by the House is unclear and will open the door for foreign firms to attract the most talented financial service employees during a time of great economic uncertainty at home. Many companies will have to raise base salaries to retain their best skilled workers and that will increase operating expenses during a time of weakness. Cities such as Charlotte and New York could get dethroned as financial centers of the world, which is ironic, because the bill sponsor is Charlie Rangel (D-NY). This is odd when you consider that Rangel’s district – New York City – has been living off of Wall Street’s bonuses and tax revenues for years.

Minority Leader John Boehner (R-OH) summed it up best when he said, “This bill is nothing more than an attempt for everybody to cover their butt up here on Capitol Hill.” In fact, the bill is to appease the mob of taxpayers that are screaming for blood, but Congress is on a slippery slope when they begin to use the tax code as a way to punish companies.

Undoubtedly, the best way for financial companies to avoid punishment is not to accept government assistance, and companies that have taken the money can repay the loans early. The legislation will place President Obama in an unusual position of trying to appease fellow Democratic lawmakers while encouraging financial companies to participate in the federal rescue programs that are designed to bolster the financial system.

Unquestionably, investors will view the unpredictability of Congress as too risky, which will discourage banks from participating in the government’s voluntary $250 Billion capital-injection program. Over 200 banks have withdrawn their applications to receive government cash and others are moving to return federal money accepted from the TARP. I cannot imagine hedge funds and private-equity funds rushing to participate in Geithner’s soon to be unveiled Public-Private Investment Fund, which will rely on private capital to buy bad loans and other assets. Most taxpayers will view these actions as positive; however, we need a healthy financial system and that requires financial companies that are stable and well capitalized.

Congress is not concerned about stabilizing the financial system, but only wants revenge on evil Wall Street bankers. Obama called the legislation “vindictive”. I, like many Americans, are frustrated and want solutions to the problems that are plaguing our country. However, populist responses to public outrage will not create solutions. We elect members of Congress to legislate pragmatically and with due process. We should all be outraged by laws that are rife with unintended consequences and lawmakers’ willingness to abuse the tax code while encouraging class warfare.